A hallmark of financial stability, the value of U.S. savings bonds lies in their simplicity, security, and backing of the U.S. government. But what exactly are savings bonds, and how do they operate?

So, it is a way for the government to raise funds for its myriad projects, from infrastructure to education. In return for your loan, the government promises to pay back your initial investment (the principal) plus interest. The beauty of the value of U.S. savings bonds lies in their low risk.

Since they are backed by the full faith and credit of the U.S. government, the likelihood of default is minimal, making them an attractive option for conservative investors.

How Is the Value of U.S. Savings Bonds Determined?

U.S. savings bonds are designed to be a long-term investment. They accrue interest over time, and you can cash them in after a certain period, usually not less than one year. However, holding them longer maximizes their value, as they continue to earn interest for up to 30 years. The interest rate of these bonds can be fixed or variable, depending on the type of bond you purchase.

The power of compound interest comes into play, meaning that the bonds not only earn interest on the principal amount but also on the accumulated interest over time. This makes the value of U.S. savings bonds grow exponentially, especially if you hold them for a longer period.

Types of U.S. Savings Bonds

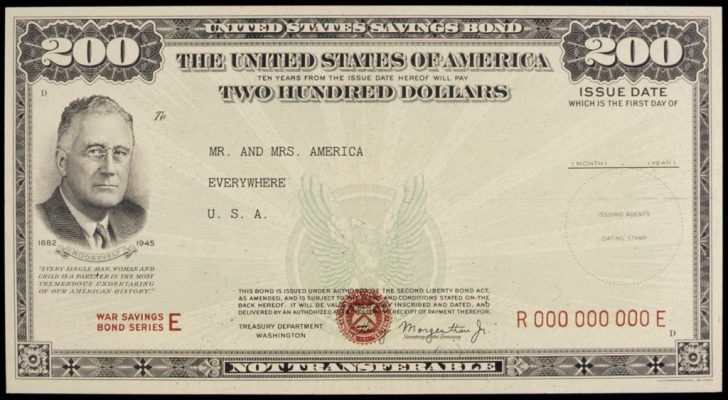

When diving into U.S. savings bonds, you will encounter two main types: Series EE and Series I bonds. Each has its unique characteristics and benefits.

Series EE Bonds

Series EE bonds are known for their fixed interest rate. Purchased at half their face value, these bonds are guaranteed to double in value over 20 years. After 20 years, they will continue to earn the same fixed interest rate until they reach 30 years or are cashed in, whichever comes first.

Series I Bonds

On the other hand, Series I bonds come with a combination of a fixed interest rate and a variable inflation rate, adjusted semi-annually. This feature makes them particularly valuable in times of high inflation. Why? Because they offer a hedge against the eroding value of money. Their ability to adjust to inflation contributes significantly to the overall value of U.S. savings bonds for investors looking for security against economic fluctuations.

So, why should you consider adding U.S. savings bonds to your investment portfolio? Here are a few reasons:

- Security: The backing of the U.S. government offers unparalleled security.

- Inflation Protection: Especially with Series I bonds, your investment keeps pace with inflation.

- Tax Benefits: Interest earned on U.S. savings bonds is exempt from state and local taxes, and federal taxes can be deferred until you cash in the bond, or it matures.

With a low minimum purchase requirement, they are accessible to almost anyone.

So, whether you are planning for retirement, saving for college, or simply looking to diversify your investments, the value of U.S. savings bonds cannot be overstated. With their government backing and tax advantages, U.S. savings bonds stand out as a reliable and valuable financial tool in any economic climate.